Hey there, daycare owners! We know running a daycare center is a rewarding gig, but sometimes parents can be fashionably late with tuition payments. Don’t fret! We’ve got your back with some genius strategies to create a contingency fund. Get ready to keep your daycare’s finances on point, even when parents are running behind schedule!

Okay, listen up, daycare superstars! We’ve all been there when parents “forget” their payment deadlines, leaving us in a financial pickle. That’s where a contingency fund swoops in like a superhero cape. It’s your secret weapon to handle those “oops, I forgot to pay” moments and keep your daycare business sailing smoothly. Let’s dive into the steps to create your very own money safety net!

3-Easy Steps To Keep Your Finances Secure Even When Dealing With Late Daycare Tuition

Step 1: Know Your Expenses

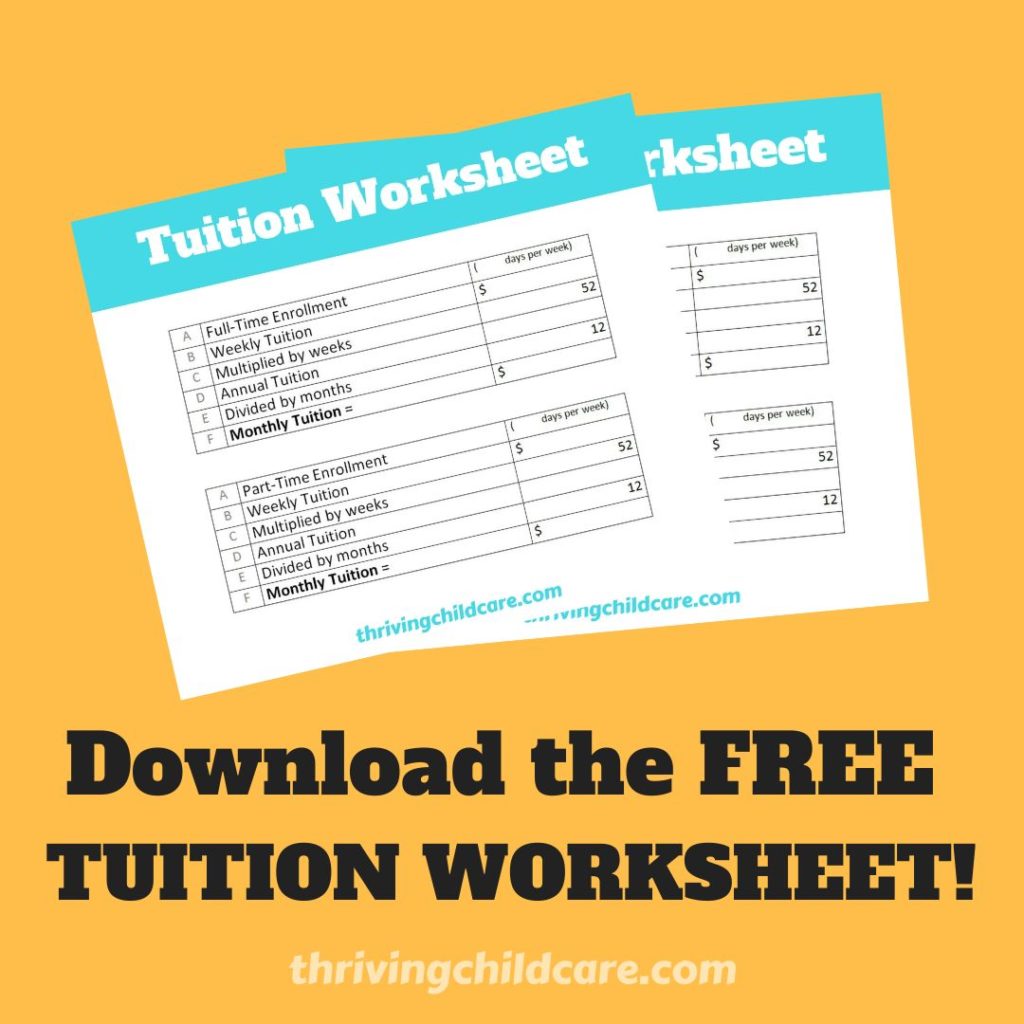

First things first, let’s assess what makes your daycare center tick financially. Add up those bills—rent, utilities, staff salaries (including your own), and all the supplies that keep the kiddos happy. This knowledge is power when it comes to building your contingency fund.

Step 2: Set Your Money Safety Net Goal

Time to play with numbers! Determine how much you need to stash away to keep your cool during those late-payment storms. Typically, aiming for three to six months’ worth of expenses should do the trick. But hey, if your daycare is one-of-a-kind, adjust that goal accordingly.

This will keep you from sleepless nights when enrollment is down or payments keep crawling in!

Step 3: Sneaky Strategies to Boost Your Fund

Now, here’s where the real fun begins. Let’s explore some clever ways to pad that contingency fund of yours:

1. The Penalty Game:

It’s time to lay down the law, daycare style. Set clear policies on late tuition payments and don’t be afraid to enforce some friendly penalties. Trust us, parents will think twice before being fashionably late when there’s a fee involved. Plus, those penalties will add some extra cash to your fund!

2. Efficiency is the Name of the Game:

Look for sneaky ways to optimize your daycare operations and save some dough. Maybe you can find a cheaper supplier for those craft materials or cut down on unnecessary expenses. Every penny saved goes straight into your money safety net.

Click to learn how using Artificial Intelligence can help you run your daycare easier!

3. Community Spirit and Fun:

Gather the troops—parents, staff, and the local community—and let’s have a blast while raising funds for your contingency reserve. Organize fundraising events, auctions, or even a daycare talent show! When everyone chips in, your fund grows faster than a group of hyperactive toddlers.

Related Reading:

- This Is When A Provider Should Absolutely Charge Childcare Fees

- 7 Super Easy Fundraiser Ideas for Childcares

FAQs (Frequently Asked Questions)

Q1: How much should I stash in my money safety net?

A1: Aim for three to six months‘ worth of expenses, depending on your unique daycare situation. Remember, it’s better to be safe than sorry!

Q2: Are late payment penalties a good idea?

A2: Absolutely! When parents know there’s a little extra charge for tardiness, they’ll be more likely to pay on time. Plus, those penalties go straight into your contingency fund.

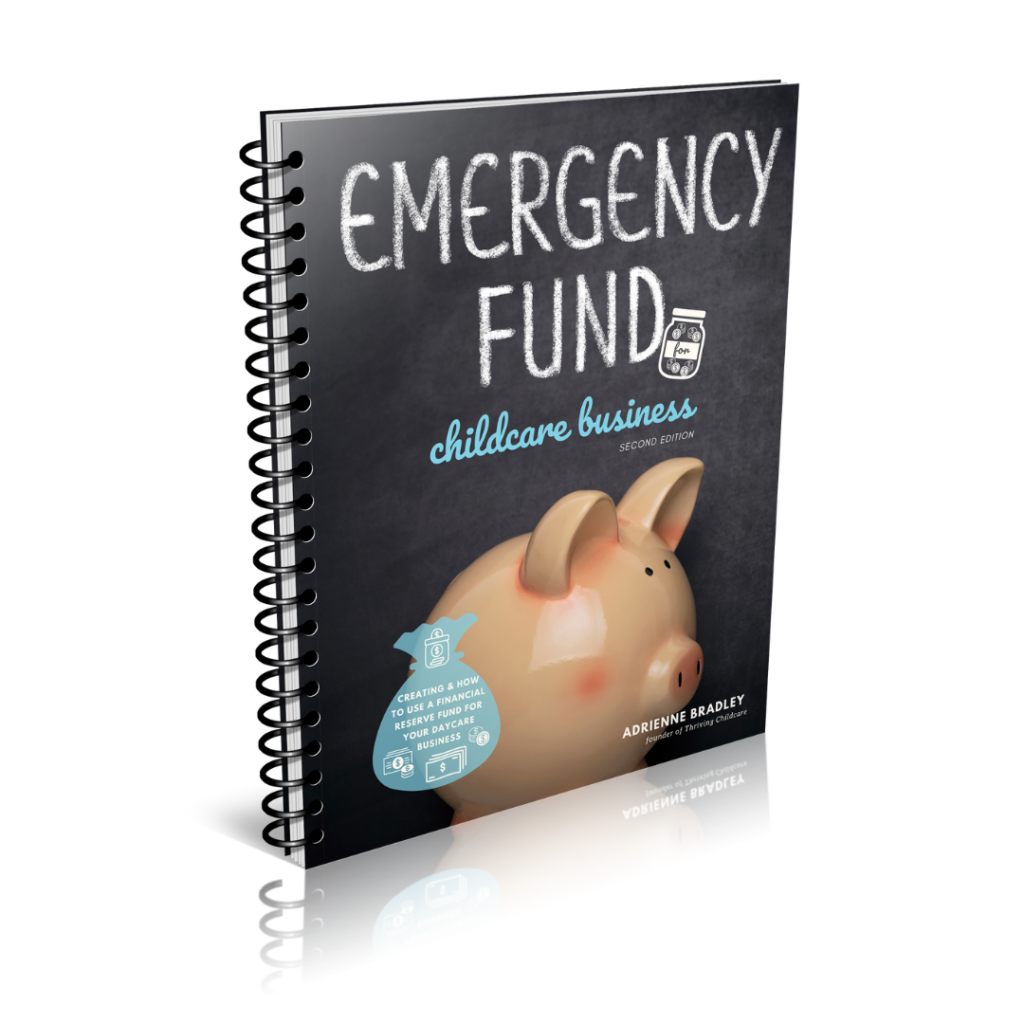

Q3: Can I use the fund for non-emergency situations?

A3: Nope, keep that fund locked away for emergencies and when parents slack off on their tuition payments

and leave you in a financial frenzy. It’s your emergency stash, so use it wisely!

Q4: Should I tell a client who is having a hardship about my money safety net?

A4: Probably not. Sharing that information could lead to parents taking advantage of your payment policies even when they recover from a temporary hardship.

[FREE DOWNLOAD] Here Are The 10 Must-Have Daycare Templates

Keep Your Finances Secure Even When Dealing With Late Daycare Tuition

Alright, daycare heroes, you’re now armed with the knowledge to create your very own money safety net. When parents are fashionably late with tuition, you won’t break a sweat. Remember to know your expenses, set a realistic goal, and implement some clever strategies like late payment penalties and cost-saving tactics. Oh, and don’t forget to rally your daycare community for some fundraising fun!

With your contingency fund in place, you’ll be the daycare owner who can handle any financial curveball thrown your way. So, breathe easy, keep your cool, and continue providing a loving and nurturing environment for those adorable little rascals. You’ve got this!