As I write this, the world is in the crisis of dealing with a worldwide pandemic. The Coronavirus (COVID-19) continues to spread and from day to day childcare providers all over the world are having to make decisions regarding their businesses.

In California, my home state, we have heard our public officials give daily revisions to guidelines. Recommended crowd sizes have changed and a panic that has driven the population to buy out food and supplies. And as we await a teleconference call in the next day, we are not certain what the immediate future holds for our businesses.

What about the Coronavirus and Childcare?

With all the uncertainty of when this crisis will end, many of us are saddled with the additional concern of what will happen financially if we need to close our business.

What will happen if parents stop bringing their children? What will happen if licensing or the health authorities advise providers to close? What can we do to make sure our childcare business financially survives the Coronavirus pandemic? Be sure to read to the end for SBA Disaster Loan Info.

3-Strategies To Financially Survive the Coronavirus Pandemic

Your Childcare Needs An Emergency Fund

Have you ever had a time when something you heard a long time ago comes flooding back to your memory? Instantly you knew it applied to what you were going through.

I had that kind of an “Ahh ha” moment this past week. In the midst of the craziness of the Coronavirus I remembered something I had heard Suze Orman say years ago “you need an emergency fund.” I instantly knew that what she had preached about so long ago, was so relevant to what our country and the world we’re dealing with today.

Ironically only a couple of weeks ago a good friend of mine, Denetra Scott of Childcare Business Launch, had done training on having a reserve for your childcare business.

In Denetra’s training, she echoed Suze Orman and suggested that childcare businesses have a four to six-month reserve or emergency fund. And the thing I had actually planned to follow up with her training with tips on how providers could build up such a reserve. And then the pandemic hit.

So now what?

We’re already here in the emergency and may need that reserve. What can we do now if we don’t have that emergency fund?

About that Emergency Fund

As I said, Suze Orman suggested that you build an emergency fund. Although she was talking to individuals and families, her advice is good for businesses as well.

In her post, Emergency Fund 101, Suze recommends building an 8-month emergency fund, while Denetra suggests a 4-6 month reserve. I say just start! Aim for four months and then build on that.

How?

Consider using enrollment deposits to build up your emergency fund. Or try allotting a certain amount of the weekly tuitions toward building your reserve.

Think this is useless info right about now? Nope! Hang on and I’ll show you why!

Even if you don’t think you can start your emergency fund, it would be a good idea to plan. Calculate what that should look like now. I’ll get to why in a minute. You can use this process to calculate your Emergency Fund.

Revise Your Contract

Last week a fellow provider asked me a question. She wanted to know if it was too late to create a policy regarding a public health scare such as this pandemic. I told her that I didn’t think it was too late. I said that in this type of circumstance a policy that was “effective immediately” could be in order.

Tom Copeland has a recent post that specifically addresses how childcare providers should respond during this pandemic. He addresses the issue of childcare tuition.

In his post, he suggests interpreting or even revising your contract and/or policies. Revising it to specifically address the Coronavirus or an unforeseeable public health scare. You can check out his contract recommendations here.

Related Reading:

- How Should Family Child Care Providers Respond to the Coronavirus?

- How to Build a Childcare Contract

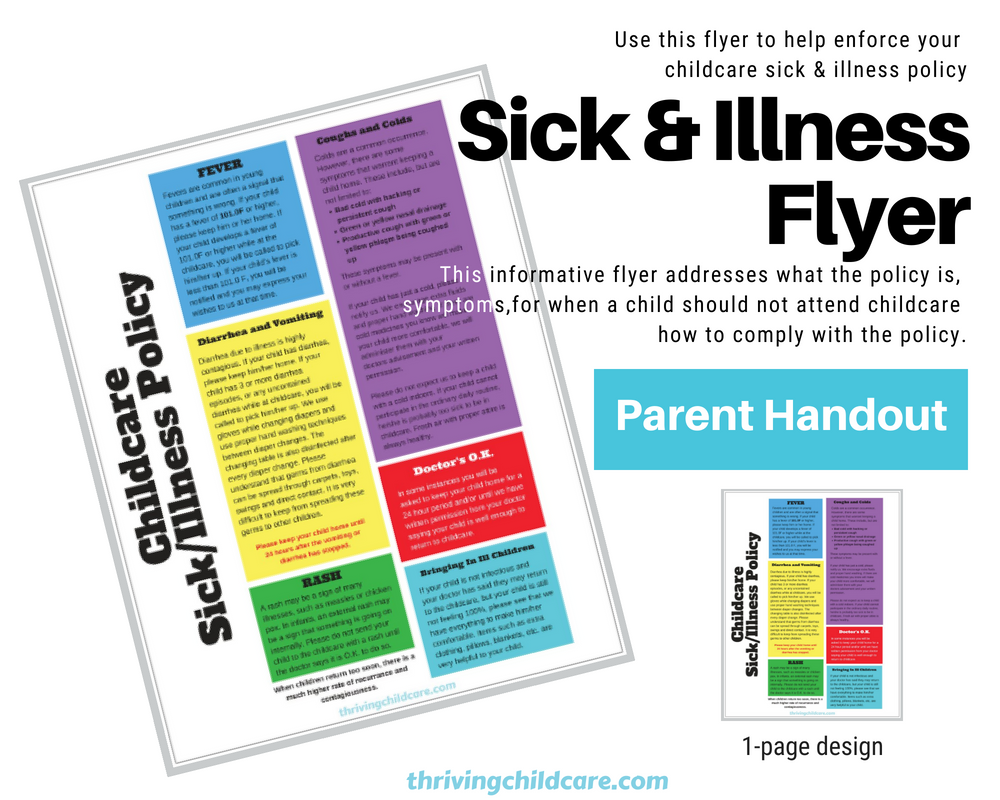

- Your Childcare Sick & Illness Policy

Childcare Guidelines

Over the weekend I was talking to a provider colleague. She shared with me this letter she was sending to your clients. The letter addresses how she is handling the Coronavirus with regards to the daycare. She also states what she expects of the parents. I created a template of that letter for providers to use. You can cut & paste and revise the letter for your business. Access that template here.

Additional Resources

- Interim Guidance for Administrators of US K-12 Schools and Childcare Programs

- California Department of Public Health* – 2019 Novel Coronavirus Guidance for Child Care and Preschool Settings

*If you are not in California, check with your state’s Department of Public Health for guidance.

Disaster Business Loan

Should you be advised or decide you need to close your childcare business, and you are in the United States, the SBA’s is set to offer Economic Injury Disaster Loans. These are for small businesses to help overcome the temporary loss of revenue.

Now you know how much to request.

So if you did the emergency fund exercise (above), and you decide you need to apply for a loan, now you know how much to request.

These low-interest federal disaster loans are being offered for working capital to small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19). For additional information, please read this article or contact the SBA disaster assistance customer service center. Call 1-800-659-2955

Related Reading:

Take it Day By Day

As hard as it may be to stay calm, as citizens, providers and business owners we need to take it day by day. If for no other reason, because things are changing daily.

Currently, no one has all the answers for handing the Coronavirus and Childcare. Just remember to regularly check with your local health authorities and look to the CDC for the most current information.

As you know more, keep your clients updated as well.

I will update this post as soon as additional information becomes available.

2 Responses

Hello my name is Julie Wallace and I’m a licensed daycare provider. I’m wondering about Aflac insurance that you suggested?

Hi Julie! Reach out to this Aflac rep – This is from my Aflac Agent, however I receive no affiliate commission from her or Aflac. I am just sharing a business resource that I use myself. >>> https://www.aflac.com/agents/tamika_jackson.aspx